Sustainability

Climate action

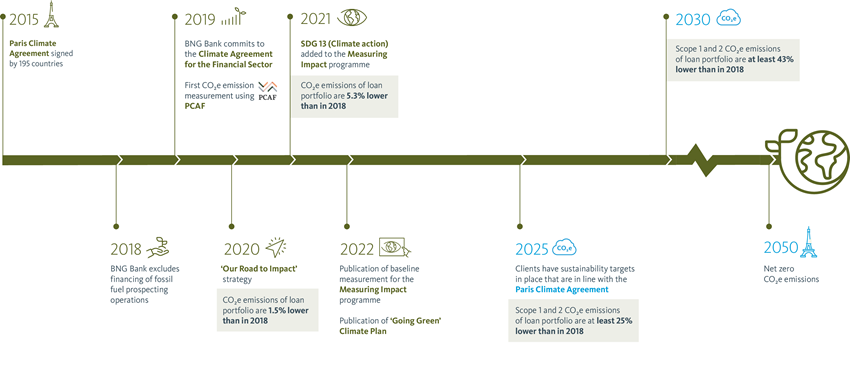

In 2019, BNG Bank wholeheartedly subscribed to the Climate Commitment for the Financial Sector to achieve a 43% reduction of CO₂ emissions of its loan portfolio by 2030 – a target that chimes in with the worldwide Paris Climate Agreement. Even before that, in 2018, BNG Bank had already decided to exclude all forms of fossil fuel extraction from financing. We may tighten our exclusion policy even further in future – for instance, if clients’ climate performance falls short of the effort required to achieve the CO₂e reduction target. 2019 was also the first year in which we mapped out the CO₂ emission levels of our credit portfolio. In that connection we joined the Platform for Carbon Accounting Financials (PCAF), which develops methodologies to calculate CO₂e emissions by financial institutions. According to the PCAF methodology, clients’ direct and indirect emissions are attributed to the bank based on a set of comprehensive valuation rules. Annually we report on our clients’ progress on the assessed indicators and on the reduction of CO₂e emissions associated with the loan portfolio.

-

PCAF Methodology approach (pdf, 2 MB)

-

PCAF report 2023 (pdf, 3.1 MB)

-

PCAF report 2022 (pdf, 2 MB)

-

PCAF report 2021 (pdf, 7 MB)

-

PCAF report 2020 (pdf, 1.7 MB)

-

GHG Emissions of BNG Bank Loan Portfolio Reporting Year 2021 (pdf, 1.8 MB)

As a next step we published our Climate Plan, ‘Going Green’ (pdf, 14.5 MB), in December 2022, in which we outline how we will work to bring emissions from our LOAN portfolio and those arising from our own operations in line with the 1.5°C target of the Paris Climate Agreement in the coming years. We will submit OUR reduction targets to the Science Based Targets initiative (SBTi) to make sure they are tested against the latest scientific insights in the field of climate change.

Making an impact with our clients: BNG Bank & Wocozon

BNG Bank has been financing the Wocozon Foundation since 2015. Wocozon helps dozens of housing corporations to make homes more sustainable by installing solar installations. In this way, the foundation makes a significant contribution to reducing CO₂ emissions and helps to keep energy costs affordable. Wocozon has already provided 35,000 social rental homes with solar panels.

Making an impact with our clients: BNG Bank & Smart City Netherlands

The municipality of Renkum is installing twelve ‘smart’ street lights that also serve as charging points for electric cars. The CityCharge street lights avoid cluttering up the streetscape with separate charging stations and help municipalities to accelerate the transition to greater sustainability. The street lights are an initiative of Smart City Netherlands, a collaboration between Primevest Capital Partners and BNG Bank.

‘Going Green’, BNG Bank’s Climate Plan

To achieve our objectives, we focus on emission reductions in the four biggest sectors of our bank's operations: social housing associations, municipalities, healthcare and education. Concentrating on the direct and indirect emissions caused by the energy consumption of real estate in these sectors.

Sector-level targets

In ‘Going Green’, our Climate Plan, we have set clear targets at sector level. For each sector, we describe the actions we expect our clients to take to reduce their CO₂e emissions and motivate them to create an emissions reduction road map, if they have not done so already. If clients have not formulated an action plan by 2025, then in future for every new real estate financing application of € 5 million or more they will have to include a plan showing that the investment is in line with the Paris Climate Agreement.

Our own operations

BNG Bank has measured the CO₂e emissions of its own operations in accordance with the Greenhouse Gas Protocol (GHG) since 2010. BNG Bank’s office building has had an ‘A’ energy label since 2017 (amply meeting the required ‘C’ label for buildings in 2023). Also, the bank has received ESG ratings of ‘C+ (Prime)’ by ISS ESG, ‘Negligible Risk’ by Sustainalytics, ‘A’ by MSCI and and ‘Advanced’ from Vigeo Eiris.

Still, we are determined to reduce emissions generated by our own organisation even further. A large-scale renovation of our office building will take place in 2024, which will involve making our building even more sustainable. Our ambition is to also include our mobility-related emissions in this Climate Plan as of next year. We already encourage our employees to travel by public transport and by bicycle.

Our progress

Every year we measure the progress of the actions we have formulated, determine any new actions and adjust where necessary. In March 2024, BNG Bank delivered a Progress Report, describing where we stand on our path to net zero emissions in 2050.

Our Progress Report shows that:

- - emissions from customers in our loan portfolio decreased by 9.5% in 2022 compared to 2021. Compared to our 2018 baseline year, the decrease is 21.8%. Our target of 25% reduction in CO2e emissions by 2025 thus seems within reach.

- - If we can continue this annual decrease in emissions, our target of 43% reduction in 2030 seems achievable.

Want to know more about our progress?